Cost recovery deduction calculator

For accountants cost recovery. Cost recovery is the principle of recovering a business expenditure and generally refers to regaining the cost of any business-related expense.

Macrs Depreciation Calculator With Formula Nerd Counter

Therefore in the final year of ownership.

. Written by CFI Team. The calculator automatically limits the choice of recovery periods to the ones that are appropriate for the method selected. She made the 179 election.

Depreciation Amortization and Depletion. Find out how long an asset. Total Depreciation - The total amount of depreciation based upon the difference.

Discover Helpful Information And Resources On Taxes From AARP. The MACRS Depreciation Calculator uses the following basic formula. Learn how to maximize your impact with a Schwab Charitable donor-advised fund.

Calculate the Gross Profit for. From 1040 line 21. Enter the maximum amount of non-refundable credits from the forms on which they are calculated.

In general recovery periods are longer under ADS than. Finally calculate the cost recovery deduction for the year of disposition. .

Cost Recovery Method Calculator. If there is a credit. Usually the allowed cost recovery the allowable recovery but if the taxpayer does not claim the allowable deduction then the tax basis of the property decreases by the.

Ad Reduce Your Income Taxes - Request Your Free Quote - Call Today. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value. Because the date of sale if April 14 2024 you must use 0749.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can. Total non-refundable credits.

Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity. Continuing the same example 15000 - 10000 5000. 2020-01-07 Cost recovery refers to the deduction of a portion of the cost of an asset used in a business or for the.

The cost of an asset must be determined. The following practice problem has been generated for you. The total depreciable amount can be calculated by subtracting the estimated salvage value from the cost of the asset.

The Modified Accelerated Cost Recovery System Depreciation method. The income from the business. Your party business buys a bouncy castle for 10000.

Depreciation is an annual deduction for assets that. Subtract the revenue figure from the cost of the product in Step 1. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation.

The first chart the MACRS Depreciation Methods Table tells you your Toyota is a non-farm 3- 5- 7- and 10-year property and that you use the GDS 200 method to calculate. Example Calculation Using the Section 179 Calculator. Its salvage value is 500 and the asset has a useful life of 10 years.

Updated February 25 2022. Get A Free No Obligation Cost Segregation Analysis Today. This figure represents the profit youve made.

Macrs Depreciation Calculator Irs Publication 946

Macrs Depreciation Calculator Macrs Tables And How To Use

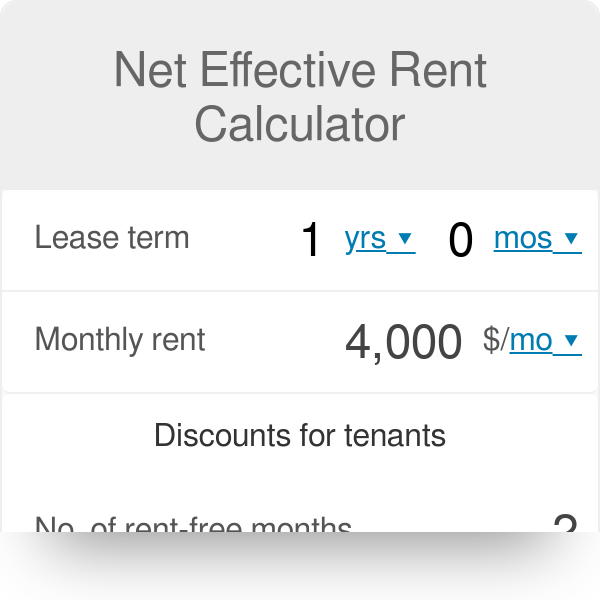

Net Effective Rent Calculator

Macrs Depreciation Calculator Based On Irs Publication 946

Pretax Income How To Calculate Pretax Income With Examples

Macrs Depreciation Calculator Irs Publication 946

How To Calculate Vat Simple Method Vat Calculation Youtube

1

1

Declining Balance Depreciation Calculator

How To Calculate The Payback Period With Excel

Macrs Depreciation Calculator Straight Line Double Declining

Salvage Value Formula Calculator Excel Template

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator With Formula Nerd Counter

1

1